German government impeding UniCredit's Commerzbank takeover

Cracking the Vault: Your weekly roundup on all things finance

Good morning and happy Monday. Today, in partnership with Remedium.

Today marks our final weekly recap, and we want to sincerely thank all of our readers for sticking with us through 130 editions. Your support has meant the world to us. We will continue delivering our deep-dives, and we hope to see many of you remain part of our community as subscribers! 🙏

Germany not selling Commerzbank shares, reducing UniCredit's acquisition chances; Lindner securing €12bn for start-ups; Equinor canceling blue hydrogen pipeline to Germany; Habeck urging Thyssenkrupp to commit to €3bn green steel; data leak at Check24, Verivox exposing thousands; Mercedes-Benz cutting forecast again as CEO's recovery hopes unmet; and VW and SAIC closing Chinese factory due to combustion vehicle demand decline.

Resolve disputes around inherited real estate with Remedium and start profiting from your assets!

Let’s jump in!

Table of contents

Markets

Headline recap

Transaction update

People moves

Macro perspective

Podcast picks

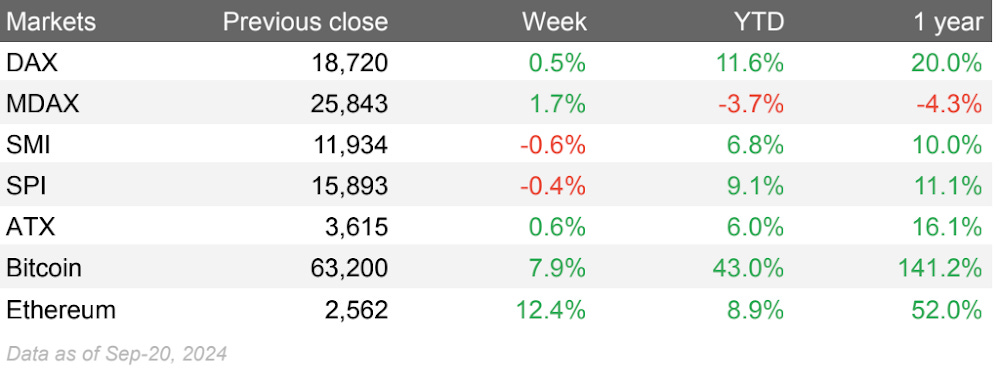

Markets

Headline recap

Top stories

German government won't sell more Commerzbank shares for now, reducing UniCredit's chances of acquiring the bank (MM)

Germany's Finance Minister Christian Lindner launches initiative to secure up to €12bn in investments for start-ups, aiming to retain profits from domestic innovations (MM)

Equinor cancels plans to export "blue" hydrogen to Germany, opting instead to convert gas to hydrogen in the Netherlands and deliver it to Germany, eliminating the pipeline to Norway (HB)

Germany's economy minister Robert Habeck emphasized that Thyssenkrupp must commit to its €3bn green steel project, warning that failure to do so could jeopardize the entire site, following concerns over rising costs (REU)

Massive data leak at Check24 and Verivox reportedly exposed private data of tens of thousands of customers, with data protection authorities now investigating (MM)

Mercedes-Benz cuts annual forecast again, following VW and BMW, as CEO Ola Källenius' hopes for stronger second half were not met (MM)

VW and SAIC plan to close a factory in China due to declining demand for combustion vehicles, as VW's market share in the country falls (MM)

Other noteworthy news

SIX, the Swiss stock exchange operator, is expanding into the carbon removal credits market to diversify its offerings (BBG)

Rheinmetall and MBDA plan to develop laser weapons for ship-based drone defense, offering economic advantages in drone warfare (HB)

SIX plans to establish European cryptocurrency trading platform to compete with Binance and Coinbase, building on existing SDX infrastructure (TP)

Vonovia offering minority shareholders of Deutsche Wohnen unit, including Elliott, option to exchange shares for Vonovia stock and receive compensation (BBG)

Geneva private bank Mirabaud harshly reprimanded by Finma for serious money laundering case with approximately CHF12m in profits being confiscated (TP)

Partners Group expands network with Mediobanca to better sell its flagship fund (FN)

Intel delays construction of its planned chip factory in Magdeburg, as announced by CEO Pat Gelsinger (MM)

A Swiss pro-market think tank suggests SNB should distribute profits directly to citizens to avoid political influence on payout decisions (BBG)

Porsche and Mercedes enlist 24-year-old Yaël Meier’s Zeam to help attract and hire Gen Z talent and customers (BBG)

A message from Remedium

Every year in Germany alone, real estate worth hundreds of billions of euros is passed on to the next generation. Conflicts surrounding these assets are extremely common and usually arise as co-owners disagree about a sale of the property. This not only blocks a release of capital, but also risks a vacancy and deterioration of the building, oftentimes provoking expensive legal battles.

Remedium is the very first and only company providing an amicable and economically sound solution to these virtually existential pain points, satisfying all parties involved:

Remedium unlocks embedded equity by buying out co-owners who are willing to sell. Remaining co-owners do not only retain their ownership stake, but also profit from Remedium’s long-term and value-oriented management of the asset. This way, Remedium provides valuable liquidity and future-proofs the asset, while also keeping the family peace.

Find out more, including ways to collaborate with Remedium.

Transaction update

M&A

Major deals

KKR acquired Axel Springer's classified advertising assets in a €13.5bn deal, with media assets like Politico, Business Insider, and Die Welt being spun off into private company controlled by Mathias Döpfner (PEN)

CVC urging Deutsche Bahn to reconsider the $16bn sale of its logistics arm Schenker to DSV, expressing willingness to raise offer after already sweetening it last week (REU)

EQT to sell Open Systems, a Swiss leader in network and cyber security solutions, to Swiss Post (PRN)

Crayon Group's shares surged as SoftwareOne reportedly exploring potential merger with Norwegian software firm (BBG)

Continental moving forward with plans to spin off automotive parts business, inviting banks to pitch for roles in listing, despite recent recalls of 1.5m vehicles due to faulty braking systems (BBG)

Raiffeisen Bank International to take €800m hit in selling 88% stake in Belarusian unit Priorbank JSC to UAE-based Soven 1 Holding, with the deal expected to close by year-end (BBG)

Cinven sold minority stake in Munich-based Synlab to US Labcorp (RD)

Other notable deals

Equinor and RWE decided not to proceed with plans for a hydrogen pipeline from Norway to Germany (BBG)

Vontobel acquires the billion-dollar client portfolio of Zurich-based IHAG Private Bank, signaling a new wave of consolidation in Swiss banking (FuW)

Chinese firm Luxshare becomes majority owner of Leoni, with Stefan Pierer stepping back, leaving the cable division fully under Chinese control (FM)

Nio shows interest in Audi's struggling Brussels plant as it seeks a European production facility due to EU tariffs on Chinese EVs (MM)

Cevian pushing Baloise to shift strategy toward Mobiliar, but without success so far, and the insurer is now considered a takeover candidate (HZ)

Bregal sold majority stake in Media Central Group for an undisclosed amount (RD)

IPO

BASF plans to prepare its agricultural chemicals business for an IPO in the coming years as part of restructuring measures to be announced at a capital markets event on September 26/27 (REU)

Venture capital

Flink, a German quick-commerce startup, raised $115m in equity (plus $35m in debt), from Bond, Mubadala, Northzone, and REWE Group (TC)

Swiss Neo Medical, a developer of an AR system for spinal surgery, raised $68m in Series B, led by Gyrus Capital (ST)

DeepDrive, a Munich-based electric motor company, raised €30m in a Series B, led by Leitmotif (FS)

Phlair, a Munich-based developer of hydrolyzer-based direct air capture (DAC) technology, raised €14m in Seed funding, led by Extantia Capital and a €2.5m grant from the EIC (FS)

Immunos Therapeutics raised $11m in Series C, led by existing investors, including Gimv and Pfizer Ventures (ST)

Smalt, a Berlin-based talent-supply and labor productivity company focused on the energy transition, raised €8m in pre-emptive Seed funding, led by Noa (FS)

Fundraising & Financing

Adler completed recapitalization and released audited reports for 2022 and 2023 (FM)

Aurelius plans to launch its European Opportunities Fund V with a target of over €750m, aiming to come to market by the end of this year (PEN)

Bankruptcies

Varta reached agreement with promissory note creditors, likely overcoming final major hurdle for approval of restructuring plan (FM)

People moves

Standard Chartered promoted Nicolo Salsano, its Germany CEO, to Head of Europe (FM)

Raffael Gasser named new top manager for private banking as Deutsche Bank shifts focus to wealthy clients, closing dozens of branches for regular customers (MM)

Meyer Burger replacing CEO and implementing deep restructuring plan, including job cuts, in effort to restore profitability (BBG)

Wind farm developer PNE will have new CEO in January, with Heiko Wuttke replacing Markus Lesser (MM)

Macro perspective

Switzerland plans to cut up to $5.5bn annually in state spending to balance its budget, which has run deficits since the Covid pandemic (BBG)

Germany is urging the EU to delay renewable hydrogen rules that raise costs for producers and hinder the development of this crucial sector for climate neutrality goals (BBG)

Economists see a significant chance of the SNB matching Federal Reserve's half-point interest rate cut (BBG)

New car sales in Europe dropped by nearly 20% in August, driven by falling demand for electric vehicles (MM)

Podcast picks

Coffee with Charlie Stephens (The HC Commodities Podcast)

The Genius Minds Behind the World’s Best Poker Bots (Big Take)

Building a Global Private Credit Firm and 'Trading' Planes with Victor Khosla (Masters in Business)

Shall We Repeal The Laws of Economics? (The Memo by Howard Marks)

Interview with John Collison, co-founder of Stripe (The David Rubenstein Show)

The Mark Zuckerberg Interview (Acquired)

Until next time, stay curious!